You Dont Need to pay From Personal credit card debt with a first Mortgage

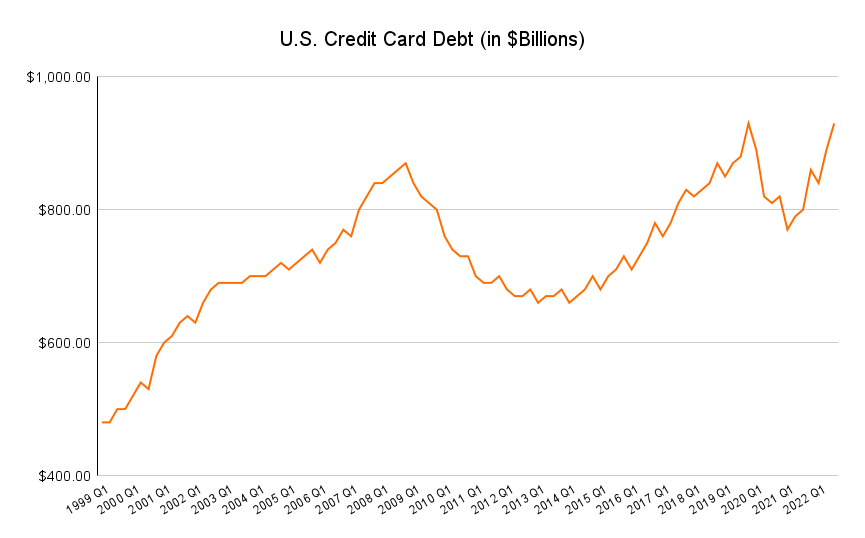

Inflation possess led to a distinguished boost in charge card stability as users deal with high prices for goods and services. Because the cost-of-living increases, people commonly move to playing cards to cover everyday costs, leading to enhanced borrowing from the bank. That it reliance upon credit try compounded of the wages that may not carry on that have rising cost of living, forcing of numerous to use credit cards so you can connection the newest gap between its money and you can costs. Simultaneously, highest rates of interest which can be a frequent a reaction to inflation of the central banking companies, allow more costly to carry an equilibrium into the credit cards.

That it mix of rising cost of living and higher interest levels produces a course in which credit card debt develops, it is therefore harder to own customers to pay off its balances and you can probably leading to deeper financial filter systems. If you have located on your own in this situation, you are not alone. On this page, we are going to mention broadening mastercard balance, delinquencies, prices, and if you should combine the money you owe to your home financing Ahead of you create a late payment.

Mastercard Delinquencies

Large stability and you can large rates is actually making particular group in the a situation in which they can be against skipped money. With regards to the Nyc Federal Set aside, credit card delinquencies try up to 8.90%. On the other hand, use rates enjoys a powerful impact on driving delinquency.

While individuals who had been current for the all of their cards throughout the basic quarter from 2024 had a median application rates out of thirteen per cent in the last quarter, people who turned newly outstanding got a median rates of ninety percent.

This type of maps and you will number inform us that high extent you may have made use of of bank card balance, the greater you are prone to as delinquent. When you’re taking maxed on their cards, then it’s time and energy to do some worthwhile thing about they Before you can skip a repayment.

For anybody holding an equilibrium into the handmade cards, particularly drawing near to its max, the latest impression of 1 late commission more than thirty days you certainly will drop its credit rating of the as much as 100 issues. This will impact their capability in order to safer future resource.

Lost a repayment with the a cards membership have extreme unfavorable outcomes in your credit rating. Commission history the most important products into the figuring your credit score, accounting for around thirty-five% of your complete score in the most common credit scoring habits. A skipped percentage, though it’s just a few days late, shall be claimed to help you credit agencies and start to become on your own credit statement for 7 age.

This can lead to a substantial miss on your own credit history, so it’s more complicated to obtain the fresh borrowing from the bank or safer beneficial interest levels. Likewise, a missed commission normally lead to later costs and higher rates to your present balance, next exacerbating financial strain. A couple of times shed payments can result in much more serious consequences, particularly defaulting into the finance, that will severely wreck your own creditworthiness and you will curb your financial possibilities afterwards.

How Domestic Security Financing Assists

With mastercard rates of interest more than twenty seven%, the key to saving money is swinging stability so you’re able to a choice having less interest rate. Just like the a house obtains the mortgage, the rate is a lot below regarding playing cards, that are unsecured. Interest rates for family security finance range between seven% to help you twelve% these days, that is lower versus 27% consumers was referring to now.

We grab a-deep plunge on wide variety, however it is crucial that you look at the long-name costs regarding minimum money to your mastercard balances together with extra money you only pay over the years.

A primary mortgage ‘s the primary financing gotten to order a beneficial family, safeguarded by the property by itself. It’s concern more than other liens or states into the possessions. The latest terms of a primary financial typically include a predetermined otherwise varying interest and an installment several months ranging from fifteen to help you 30 years. Conversely, an extra mortgage, labeled as a house guarantee mortgage or personal line of credit, is an additional financing removed from the guarantee on the home, which is the difference in this new house’s economy really worth and you may the remainder harmony into first mortgage.

Second mortgage loans normally have large rates than just very first mortgages while the he could be under. In case your debtor defaults, another home loan company is just paid after the first mortgage lender was found. Despite the greater risk, next mortgages might be a good monetary product for opening significant fund to possess biggest expenditures eg home improvements, education, or debt consolidating.

If you have a good financial speed on your very first financing, the second is a much better choice for you. In any event, getting rid of personal credit card debt pros somebody who was approaching being maxed out. Refinancing could save you money, releasing upwards more funds on the month-to-month budget if you find yourself working for you avoid the danger of lost costs and damaging your credit score.

To conclude

The amounts show that more and more people are becoming closer to having and also make difficult financial decisions about their financial obligation. The best thing to-do is always to look at your choices just before you’re forced to create an arduous options that’ll payday loan alternative Fultondale significantly apply to your financial future.

Refinancing to a first otherwise 2nd financial would be a strategic proceed to stop delinquency and you will save money. Because of the refinancing, you can even safe a reduced interest rate, that will reduce your month-to-month mortgage payments, which makes them way more in balance. This is exactly such of use if you have viewed a rise in your earnings or an enjoy in your house’s really worth because you took your unique home loan. At exactly the same time, refinancing makes it possible for you to definitely consolidate large-attention bills, such mastercard stability, into the a single, lower-focus financing.

It besides simplifies debt debt but also decreases the total appeal you only pay, releasing up income and letting you remain most recent in your costs. Refinancing shall be an important equipment while we are avoiding delinquency and having long-term financial fitness by decreasing month-to-month costs and you can improving economic stability. Tell us how exactly we can help you Prior to a belated fee pushes your credit score also reduced so you can qualify.