The Guide to Home improvement Resource when you look at the New jersey

The need for do-it-yourself during the Nj can never end. New jersey residents are continuously growing the rooms, renovating dated room, or upgrading equipment. not, the need to replace your home shouldn’t be affected by the brand new anxiety about resource one do-it-yourself. Most of these home improvements and you can updates want a serious investments. Although particular homeowners could have the income offered, others should discuss resource selection. Aren’t getting overwhelmed. Financing your following do it yourself must not be an intricate clutter.

For this reason At that moment Renovations have alternatives for people to get their second up-date completed. Today we’ll speak about some different capital choices for renovations, like HELOCs, 2nd mortgages, and you may do-it-yourself financing because of Enhancify.

Already treated the money and ready to begin your next house upgrade endeavor within the New jersey? Get in touch with On the spot Renovations and you will talk to an expert now.

What is HELOC?

First up, we’ve got HELOC, otherwise Home Guarantee Personal line of credit. Using this type of alternative, residents borrow on the fresh equity of its household, delivering a flexible way to obtain money to possess another type of do-it-yourself enterprise. Like credit cards, HELOC allows people to view financing as required, and only shell out interest into the count that gets borrowed. This 1 typically has less first interest than many other types of borrowing, making HELOCs a repayment-effective selection for capital.

Normally, notice paid off on good HELOC are income tax-deductible if your finance are used for home improvement. Nj-new jersey residents should think about it a lot more advantage of HELOCs been tax date.

Whenever you are HELOCs have a tendency to render a lesser initially interest, such cost are typically varying and certainly will change, that trigger highest monthly payments when the interest levels go up. Homeowners and are in danger regarding foreclosure to their domestic in the event that they neglect to repay the HELOC. Please remember those individuals annoying settlement costs and https://paydayloanalabama.com/harvest/ you will charge. For example assessment charge, software charges, and you may yearly repair charges. Any of these costs is sneak up towards the people and you can add right up more know.

Think an extra Mortgage

You to option for Nj-new jersey people to look at is actually an additional mortgage to finance their second do-it-yourself project. Remember, although not, of the advantages and disadvantages for the option.

Perhaps you have believed getting the next home loan? Exactly like HELOCs, these mortgage loans allow it to be property owners so you can borrow against this new collateral of their domestic. Yet not, in the place of a credit line, a second financial will bring a lump sum payment upfront. This will be a beneficial selection for Nj residents trying fund good-sized do-it-yourself plans or combine loans.

A unique change regarding HELOCs is the fact 2nd mortgage loans typically offer repaired interest levels in lieu of changeable rates of interest, offering top balances and you can predictability in the homeowner’s monthly payments. Next mortgages will come with stretched fees terminology compared to the other types of borrowing from the bank, allowing homeowners so you’re able to dispersed the repayments and perhaps keeps a great lower payment.

Once again, just as in HELOCs, second mortgages work on both risks of foreclosures having incapacity in order to pay-off and you may troubling closing charges. Additionally there is the possibility of more credit. Having a large lump sum, many property owners is tempted to save money than just they’re able to afford, making them accumulate a great deal more loans than just they could conveniently spend. If you undertake an extra financial, ensure that you borrow sensibly and you can consider your a lot of time-name financial desires.

Home improvement Credit Choice

Nj people likewise have some other credit alternatives, for example playing cards and private fund. These choice give easy and quick entry to money and you will independency when you look at the money options. However they normally do not require collateral, like home security, in lieu of HELOCs otherwise second mortgages.

As well as such pros, New jersey people should become aware of any possible cons to having credit alternatives such credit cards or personal loans. For 1, they generally were highest rates of interest than other resource solutions, leaving property owners which have higher monthly installments. They might additionally include smaller fees words, putting more stress on money. New jersey homeowners provided this type of borrowing from the bank alternatives need to look to own aggressive cost and versatile cost alternatives.

In terms of these borrowing choice, residents should behavior a few good financial models to manage the borrowing intelligently. Cost management is very important, and you will people resident should would an in depth funds detailing investment can cost you before taking toward debt getting home improvements. Remaining bank card balances reasonable is a great behavior helping to avoid maxing out credit constraints. It will help having monthly premiums, and an excellent behavior with these will be to shell out timely to stop later fees to steadfastly keep up an optimistic credit rating.

Establishing Enhancify

With these selection, it might seem challenging to decide what exactly is right for your next do it yourself investment during the New jersey. It’s important to mention several options and you will think about your private problem and needs.

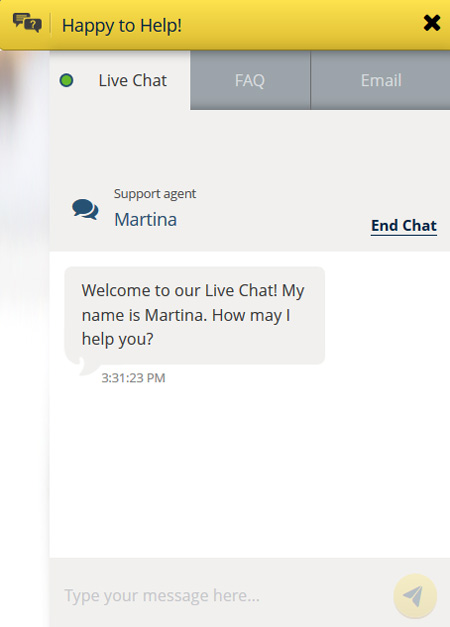

On the spot Renovations has hitched having Enhancify to offer Nj property owners financial support alternatives for brand new home update methods. Enhancify was a trusted on the internet platform you to definitely links homeowners with reputable lenders, therefore it is easy to find aggressive loan also provides designed in order to personal need. Obtained simplistic the applying process to guarantee a delicate and you may dilemma-free experience. And with their higher community away from loan providers, property owners keeps several loan options during the the convenience.

Think of, examine competitive prices and flexible commission choices before repaying. Enhancify aids in this action from the concentrating on investment solutions which can most useful suit your need. Immediately following accepted, funds from Enhancify finance are usually spreading rapidly, making it possible for property owners to move pass along with their home improvement preparations versus decelerate.

Do it

Home improvement money performs a vital role inside broadening the life style area, renovating an old area, updating equipment, otherwise any type of your future opportunity you are going to involve. Nj people enjoys various possibilities to them, should it be compliment of HELOCs, 2nd mortgage loans, otherwise borrowing from the bank options owing to Enhancify. By weigh the advantages and disadvantages of each and every solution, homeowners is judge which helps make the extremely sense for them.

From the Immediately Renovations, we are committed to providing people in the Nj-new jersey arrive at their residence update goals compliment of accessible and flexible investment choices. Speak about Enhancify right now to find out what options are nowadays.

When you’re ready first off that 2nd do it yourself project, see Immediately Renovations and you will speak with a specialist on the turning this new sight toward fact.