FHA Streamline Re-finance against. Conventional: Which is Ideal?

For the majority of earliest-big date homeowners, an FHA mortgage loan gives the liberty you should afford property. One to perk for FHA borrowers is the smoother FHA streamline re-finance.

Once sometime has passed on the brand new home, you might wonder from the refinancing their FHA loan. FHA individuals possess the option of a normal refinance.

If you are looking when planning on taking benefit of current rates of interest or to switch their words, you may have a few options to look at.

What are Your Re-finance Selection?

Once you refinance your home, you alter your most recent financial that have one that is a whole lot more beneficial. For example a lesser rate of interest, altering the identity length, or cashing your security.

FHA Improve Re-finance

Using this kind of refinance, an assessment is not needed, therefore don’t need to tell you income confirmation. There isn’t any lowest credit rating needed, no prepayment punishment.

In the event the economy rates of interest try below your own FHA pick mortgage rate, you range process. This, therefore, often decrease your monthly payments.

Traditional Re-finance

- Rate-and-name re-finance

- Cash-out refinance

- Decrease your monthly payment from the cutting your interest

- Clean out mortgage insurance fees for those who have 20% or more home guarantee

- Lower your mortgage shorter by the shortening the identity length

A cash-away refinance replaces your financial with more substantial one which can be 80% of your home’s really worth. Once you intimate on your this new loan, you can get the real difference within the bucks.

Many home owners whom purchased their property that have an enthusiastic FHA mortgage decide so you can re-finance so you can a conventional loan to allow them to liberate of its mortgage insurance policies. They often times use their security to pay off personal debt otherwise build renovations, too.

Criteria getting Old-fashioned and FHA Streamline Re-finance

A normal re-finance offers a larger directory of terms and opportunities, and with that will come closing costs and you can stricter criteria.

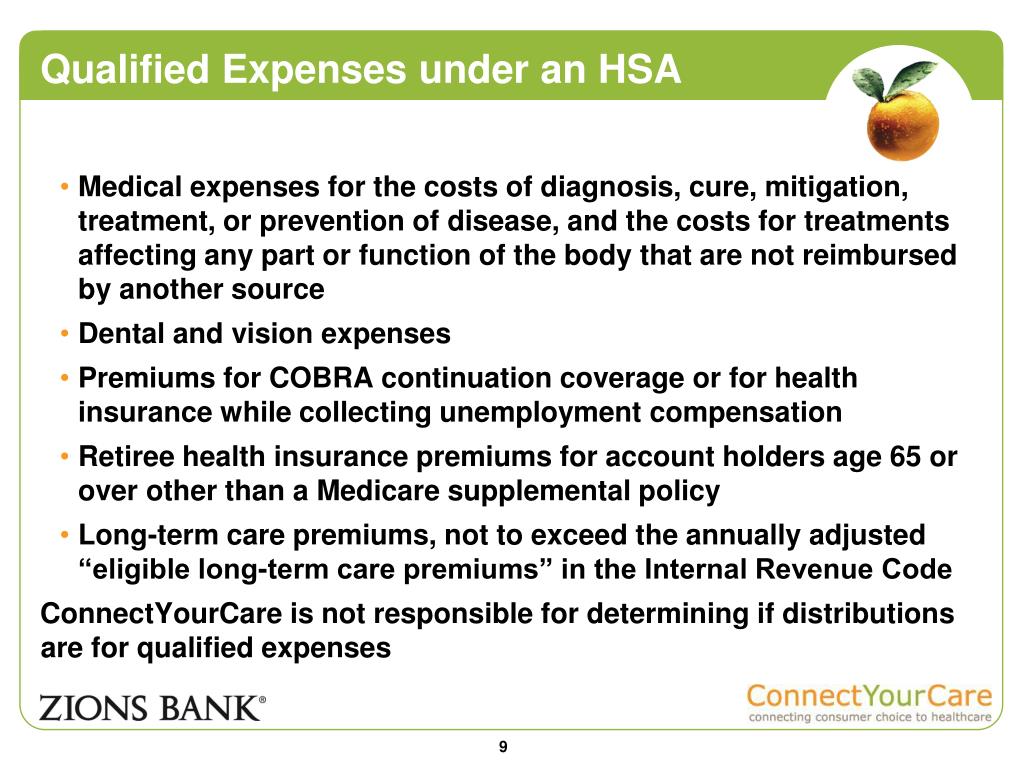

FHA Improve Requirements

To qualify for a keen FHA Streamline home mortgage refinance loan, you truly need to have a current FHA-insured mortgage, up-to-time costs made-over for the past 6 months, without multiple later commission in earlier times year.

- Latest financial declaration

- A career confirmation

- A couple months out of financial comments

- Present power bills

Since process is much simpler no assessment required, financing origination fees are straight down. You continue to are certain to get specific closing costs to spend, but can possess options to trade such charge in for an effective a little higher interest rate.

Keep in mind that by using yet another FHA mortgage, you are able to still have to pay home loan insurance costs. Although not, the ease out of degree and lower interest rates always generate such sort of loans worth every penny to help you borrowers.

Antique Re-finance Qualifications

In lieu of an FHA refinance, you can refinance to a conventional loan even although you features an alternate loan types of, including an FHA otherwise Virtual assistant financing.

If you do not features 20% guarantee in your home, you happen to be required to pay monthly to have private financial insurance.

Settlement costs to own conventional loans usually range from dos% and you will 4% of amount borrowed. This type of will check this site cost you through the loan origination charges and you will an assessment.

On the service of your leading home mortgage administrator, make an effort to see whether the expense and you can deals from your brand-new mortgage are worth their if you find yourself.

Simple tips to Refinance into Best Mortgage Manager

The decision to refinance includes of a lot factors. Ideal home loan officer has an interest in building a love to you so you can decide which financing choices are finest to suit your unique disease.

When you’re prepared to make the step two for the refinancing to a keen FHA improve or conventional loan, get in touch with the professionals on River Town Home loan today.