Conforming and you may FHA Mortgage Constraints by the State

Article on Ohio Mortgages

This correct heartland condition has a lot to offer, off large, open prairie and wheat fields to Hutchinson’s Cosmosphere and Space Heart, including Wichita’s aviation earlier. Regarding a property, you will find that Ohio financial pricing try over the national mediocre, even though they’ve got historically become lower than it.

National Mortgage Cost

- Kansas property taxation

- Ohio old-age taxation

- Ohio income tax calculator

- Discover more about mortgage pricing

- How much cash household is it possible you manage

- Estimate monthly mortgage payments

- Infographic: Best towns locate a mortgage

Ohio Mortgage loans Evaluation

It is normal observe straight down home values in the Midwest, and you will Kansas isn’t any exception to this rule. New average domestic value try $183,800, due to the fact federal average are $281,400.

Kansas has easy revelation laws and regulations getting vendors compared to the other individuals of the nation. If you’re looking a home in the Ohio, it is vital you to definitely consumers be aware with regards to a property buy. An informed move to make should be to arrange a property assessment with a highly-trusted inspector or team. This may shield you from to find a house that disastrous defects.

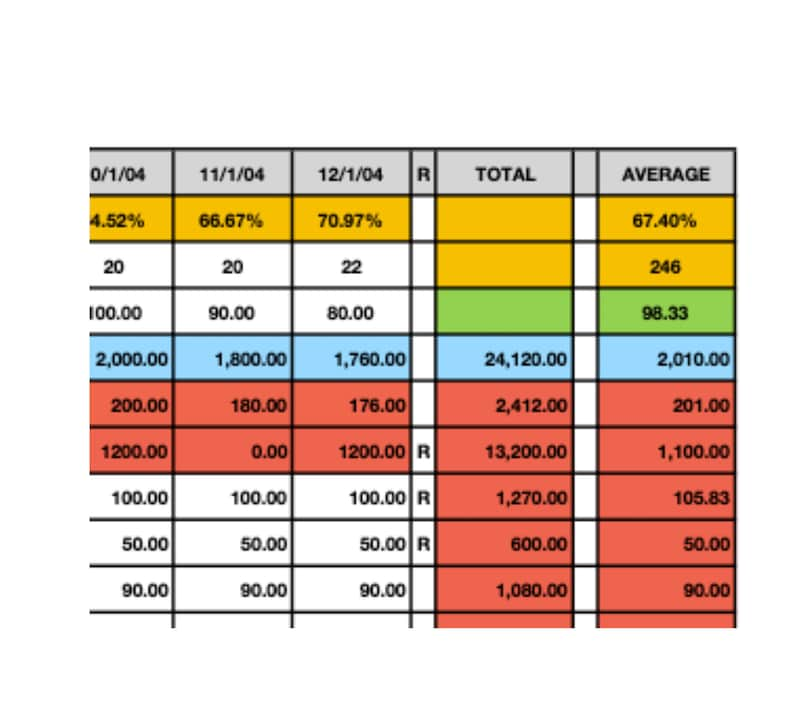

30-Season Fixed Financial Rates into the Kansas

Fixed-speed mortgage loans is the popular style of lenders. Interest rates you to definitely are nevertheless the same during the course of new loan make it easier to budget for monthly obligations. That means you understand exactly what you will get into the whenever you sign the mortgage and your monthly installments will continue to be regular typically. The most used try 31-seasons fixed-price mortgages hence tend to have high rates however, down monthly payments. Another option are good fifteen-season loan. This type of generally have down interest levels however, high costs.

Ohio Jumbo Financing Costs

Land from the nation’s bread-basket are generally inexpensive than just the typical Western family, therefore, the compliant mortgage limitation ‘s the basic $726,2 hundred around the most of the counties. If you want to take-out a bigger mortgage that than to your household you may have their eyes to your, there are what exactly is experienced a jumbo financing. Keep in mind that jumbo funds has large interest rates. Providing a loan that is bigger than brand new conforming mortgage limitation presents a much bigger chance getting loan providers. Finance companies mount higher rates to jumbo finance in an attempt to pay into the a lot more chance. But not, jumbo financing mediocre into the Ohio are actually lower at this time.

Ohio Sleeve Loan Pricing

A variable-rate financial (ARM) try that loan you to typically offers a lower life expectancy rate of interest right up side than just a predetermined-rates home loan. The reduced price can be found for a time period of one, around three, five, eight otherwise ten years. Immediately following that point is over, the speed will increase annually. There are certain monitors in position, yet not, to prevent buyers who prefer Arms out of unexpectedly getting out of bed to help you an inflated rate of interest. The loan’s terminology commonly establish how many times the interest rate can go up-and maximum you can easily height that it can arrived at. It is important to check one rate of interest limit and also make certain that its you to you can afford to pay before you have decided one a supply is the better one for you. Strangely enough, Sleeve costs are presently more than its fixed competitors.

Kansas Home loan Resources

If you would like advice to order a home throughout the Sunflower Condition, the fresh Kansas Property Resources Corporation enjoys forgivable money having earliest-date homebuyers to reduce out-of-pocket costs associated with to purchase a property. Whenever you are a homeowner, you are able to weatherize your residence to get more productive heat and you will air conditioning into the weatherization direction system. To own buyers who don’t be eligible for government homes assistance, the newest Moderate Money Houses program helps you supply loans and you can offers.

First-day home owners also can discover assistance from the Ohio Housing Recommendations System. When you buy a property, to find will cost you accumulates fast. But if you might be buying your first house and you are clearly eligible, you can get as much as 4% borrower bucks having a deposit and you can settlement costs with this particular system. However they provide unlimited capital and 31-12 months repaired-rates funds with high mortgage-to-really worth financing, therefore irrespective of where when you look at the Ohio you are looking, this is a money of these simply starting out.

Readily available Resources

The us Agency off Farming Rural Development system has the benefit of financing assist and you will home loan offers on entire country. The applying will let generate so much more outlying areas of an excellent condition and provides safe, affordable casing to have people. Ohio has offers and you will loans readily available for family solutions too since mortgage advice apps in the event you qualify.

Ohio Mortgage Taxation

Residents are allowed to deduct the mortgage desire they spend when it document their federal income taxes. That it is applicable getting Ohio condition income taxes too. You might double on the write-offs toward qualifying home loan interest costs you have made on income tax seasons by the including all of them with the each other state and federal filings. Ohio generally employs federal advice to possess itemized write-offs.

Inside the previous age, Ohio recharged good 0.26% financial commission towards the a home purchases, but that’s no longer the fact by . A plus to have Kansas consumers and you may sellers, that it condition does not costs taxes toward real-estate term transfers, which means you won’t have to pay a payment for one.

Ohio Mortgage Re-finance

If it’s time to re-finance, you really have a couple alternatives. The home Sensible Refinance System (HARP) no longer is offered, but Federal national mortgage association already has the benefit of its own option, taking being qualified individuals use of notice and you can prominent commission decreases because the really just like the reduced settlement costs.

If not be eligible for either of them, remember you usually have the option working toward financial exactly who awarded your existing financial and you can researching re-finance cost with other loan providers to ensure that you home into a solution that truly works for your position.