Sooner, you are needed to pay off your home mortgage fundamentally with a good balloon mortgage

Get A bid

All of the homebuyer’s condition is different, and since of this, there are various home loan solutions to accommodate consumers. A balloon financial isn’t as preferred while the other types of domestic money as there are an advanced level regarding exposure involved than the more conventional choice. However, for almost all consumers, the key benefits of a balloon mortgage can also be provide more benefits than the potential drawbacks.

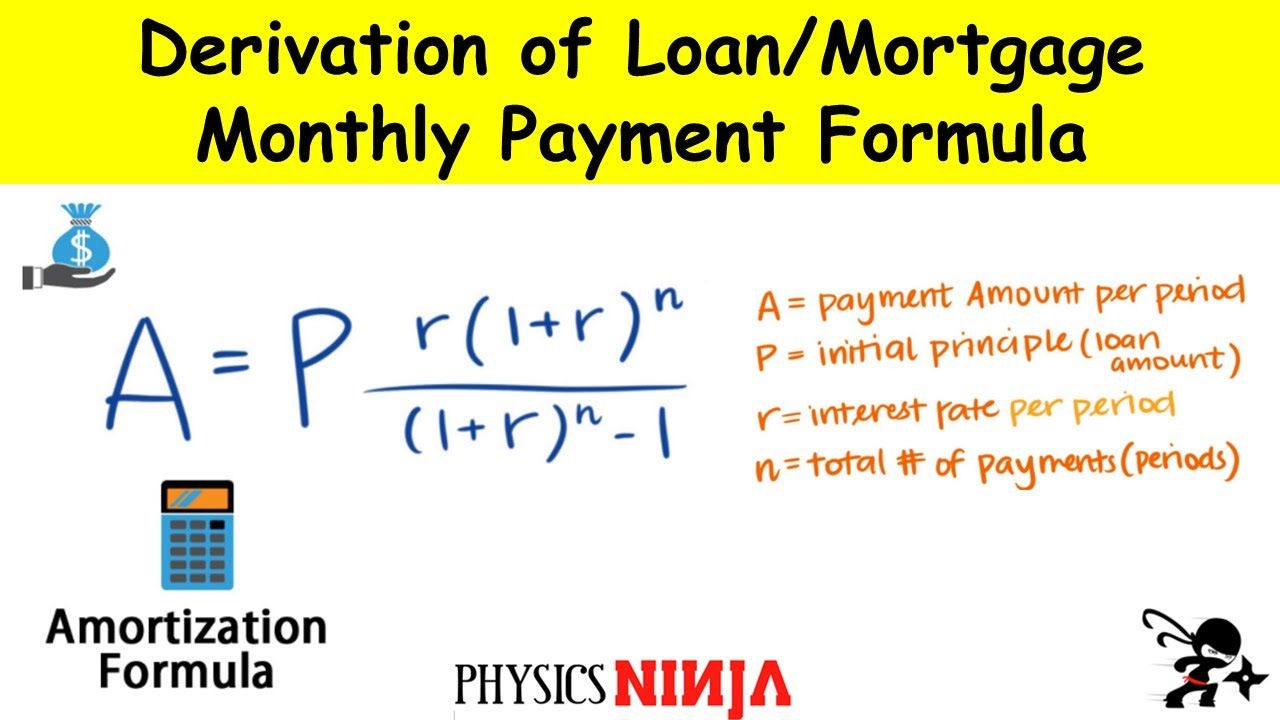

Balloon mortgages start off with repaired monthly installments for some ages, but then consumers will be required to expend the remaining harmony all at once, which is known as the balloon payment. Before the balloon percentage, yet not, monthly payments are typically lower than they might become than the home loan repayments which have a very conventional design.

That have a good balloon mortgage, the word (number of years that debtor has to pay back the loan) is significantly less compared to amortization period (what number of decades more than that your mortgage’s payments try calculated). Including, that have a normal 29-year repaired-speed financial, consumers can get an identical month-to-month mortgage payments monthly through the living of your loan, which is 360 payments in total.

Balloon mortgages try arranged in a different way. As an alternative, a debtor ple, ten years, with a thirty-seasons amortization. Their monthly mortgage repayments may be the exact same for these 10 many years as if your financial name was three decades, however, following ten-seasons several months is actually up, you’re necessary to spend the money for leftover equilibrium all upfront.

Great things about balloon mortgages

This new reduced name that is included with balloon mortgage loans is going to be a biggest virtue, depending on how you look on it. However with a shorter loan identity, it indicates they costs you less money once the you are using quicker when you look at the appeal along the lifetime of the mortgage. This may offer the unique chance to own your residence totally free and you may clear in only a portion of the amount of time, while most home owners just take thirty years to settle its mortgage loans.

A special enticing advantageous asset of balloon mortgages that are the no. 1 motivator getting borrowers ‘s the all the way down interest. Qualifying individuals are likely to has lower monthly obligations through the 1st repaired months because of significantly more beneficial pricing.

After you merge the larger financing limitations having down desire and you can monthly payments, very individuals find that balloon mortgages let them have the chance to pay for the dream house. The flexibility means homebuyers is typically borrow far more, that can easily be called for, with regards to the home they truly are looking to get. Although not, it is additionally vital to cautiously imagine if or not borrowing a whole lot more because you might is really worth starting, and this the cost of the house you are looking at remains reasonable and you can feasible predicated on your allowance. You have got to check out the cost of maintenance and you can restoration, assets fees, associated costs from life, or any other activities. Above all else, you have to be specific you will be effectively open to this new balloon payment.

Downsides away from balloon mortgage loans

One drawback is that borrowers may face dilemmas refinancing once they ultimately change the thoughts and you can favor another kind of home loan. So you can qualify for a refinance loan, some household collateral is usually needed, and you may borrowers which have balloon mortgages will lack far (otherwise any) security before the stop of the mortgage identity anyway. Market changes may also succeed more challenging to help you refinance if the property philosophy fall https://elitecashadvance.com/personal-loans-nc/columbus/ off. Rather, you are capable re-finance into another mortgage when the you may have enough drinking water dollars from the closing.

If you are looking on balloon mortgage loans since the you are looking for an choice that gives a very positive rates, an effective balloon financial will most likely not necessarily be your best bet. FHA, Va, and you can USDA fund, instance, get every provide all the way down rates or any other tempting features, such reduce fee conditions. Likewise, because these mortgage loans amortize entirely, individuals don’t have to bother about brand new balloon payment. But not, it is very important observe that qualifications of these other kinds of mortgages is founded on certain conditions. Incase it comes to balloon mortgages and you may financial prices, the possibility of business position transform and you may interest levels rising or down normally significantly impact the complete cost of one’s mortgage.

.jpg)