Jumbo Case Financing Safe a minimal 1st Rate of interest with the Mortgage Numbers Up to $3m!

Want to Discover more?

If you were to think this choice is good for you, please reach out to one of the experienced Loan Officials today! We are here to respond to all concerns that assist you select the best loan substitute for suit your needs!

What is actually an arm Mortgage?

When protecting a mortgage, specific individuals ask yourself whether to choose a fixed-speed or a varying-rate financial (ARM). A supply was home financing with an intention rate that adjusts throughout the years to help you mirror industry criteria. That have crossbreed Palms, individuals could possibly get supply an under-markets rates getting a fixed term (generally 3-ten years) before its the best variations. Overall, the fresh new reduced the first months, the greater number of advantageous the latest introductory installment loans online Tennessee rates provided. Following first fixed period, the pace try possibly elevated or reduced with respect to the index price. Even though many financial consumers choose a predetermined-price financing for the stability, there are numerous professionals to help you a supply loan.

As to why Favor an arm?

- A comparatively down price once you purchase otherwise re-finance, repaired to your totality of introductory several months (usually step three-ten years)

- Make use of latest family guarantee to acquire bucks owing to a funds-out re-finance if you find yourself however keeping a reduced payment

- Afford a different or larger home with a reduced very first commission

- Pay faster for the financial when you look at the property you intend so you can stay in longterm

How can we Let?

First Home loan also provides an excellent Jumbo Sleeve Financing, offering the chance of a lower life expectancy initial interest to possess loan wide variety over antique mortgage constraints.

The Protected Overnight Financing Speed (SOFR) Arm offers a fixed price months followed closely by partial-yearly modifications to the interest rate. The newest unit even offers 5 12 months/6months, seven 12 months/6 months and you can ten 12 months/half a year choice.

This specific loan choice is available and money-out home mortgage refinance loan quantity to $step three million cash! It means being qualified borrowers have the chance to safer a beneficial below-market fixed rates for 5, 7 otherwise ten years!

For individuals who otherwise someone you know have an interest in to acquire otherwise refinancing a property, excite contact one of our knowledgeable Financing Officials today to discuss your best choice!

5 A property Frauds to watch out for

Whether you are purchasing, selling, or refinancing property the very first time or 5th, you’ll end up controlling many pointers, documents, correspondence, and deals. It can be an easy task to score overwhelmed, and you can regrettably, discover someone available to choose from which can get make an effort to utilize people throughout a house deals. Listed here are five preferred home scams you should be aware out-of in order to avoid getting cheated.

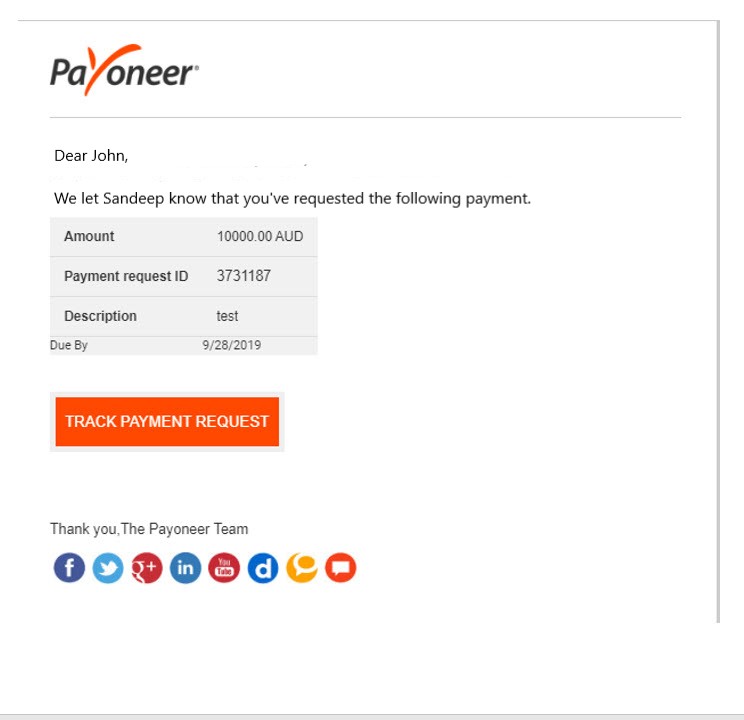

Cord Fraud

Perhaps the preferred a residential property fraud is actually wire scam, especially in reference to escrow. This type of cons generally take the version of some kind of interaction, should it be of the mobile phone otherwise email address (now, its mostly email address), away from a single stating to be a real estate agent of the escrow or identity organization. Might give you recommendations based on how and you can locations to wire the cash. Cable fraudsters are becoming much more excellent inside their tactics; they frequently fool around with fake websites and you will email addresses designed to echo that of the company you are coping with to make them look genuine. What is important you do not unlock any website links you are not yes about and that you consult your Financing Manager to verify any directions you received try particular. Refer to contact info your before gotten from the lender, title team, and you can closure agent rather than assuming that which was within the phone call otherwise current email address.