step 3. Va fund limiting or promising owner to blow specific closure will cost you

There is absolutely no individual financial insurance rates (PMI) having Virtual assistant loans. However, Virtual assistant financing perform come with a mandatory capital commission one goes straight to the latest Institution away from Pros Items. Borrowers having a help-linked impairment was excused out of expenses so it payment. This will help to save on the fresh monthly premiums and you will upfront will set you back. This will make a sacramento or Placer County house inexpensive.

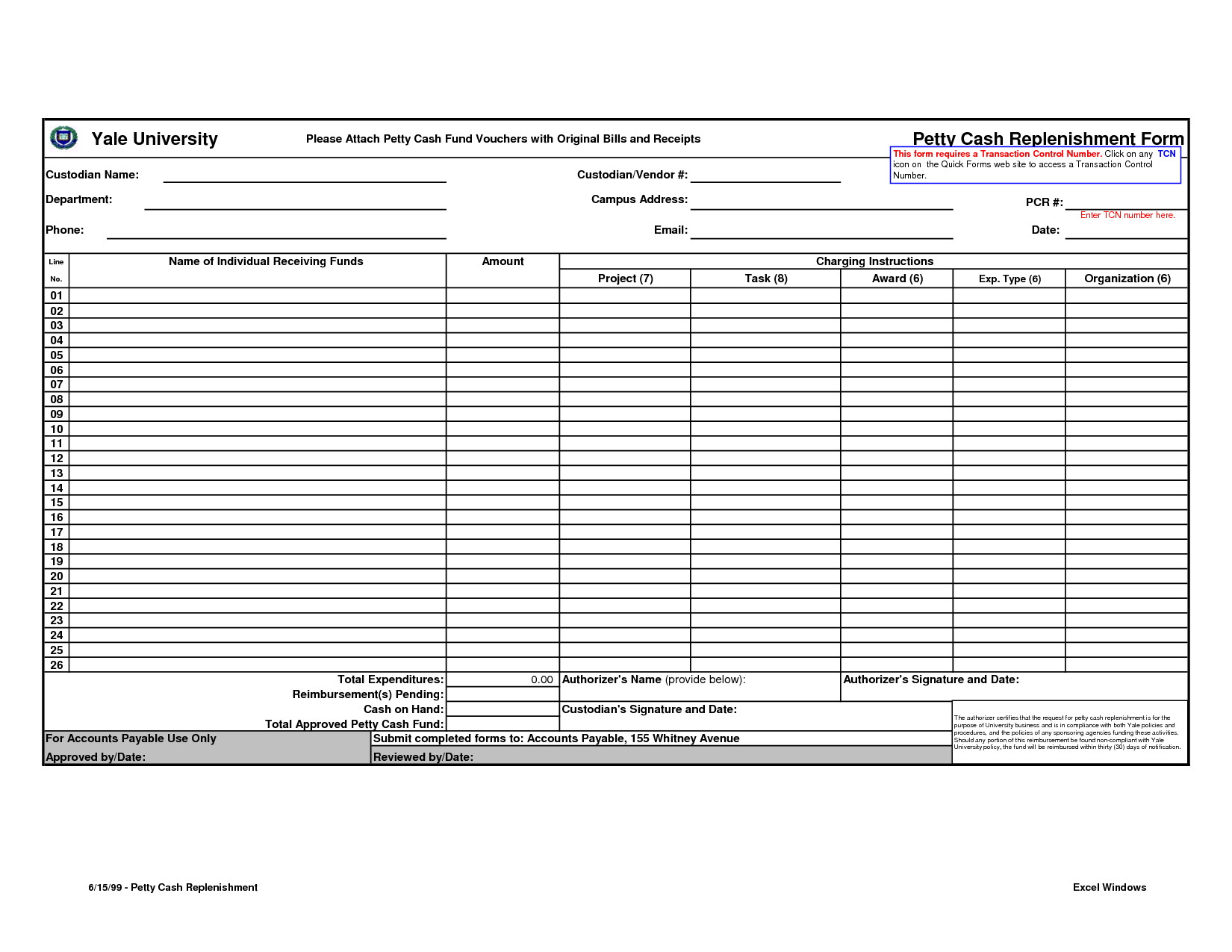

During the 2022 the newest Virtual assistant loans Clifton money percentage prices is actually just like the then followed:

Closing costs are included in providing a home loan. Brand new Virtual assistant indeed limitations what costs and you may will cost you pros pays during the time of closing. This is not always a good point. Sometimes it can be complicate a bona fide property deal. Brand new experienced family client will get specific closing prices guidelines.

Our home buyer/s can query providers to invest almost all their mortgage-relevant settlement costs or more so you’re able to cuatro percent of one’s buy speed to possess things such as prepaid service fees and you can insurance, selections and you may judgments. Do you believe the new seller’s need to do that? Do you really believe specific seller’s cannot accept an offer if the its uncovered that it’ll end up being a beneficial Virtual assistant financing buyer? I have had numerous product sales generated more challenging to close while the away from hopes of new seasoned client considering they will certainly instantly score such seller’s concessions. Home buying ‘s the artwork out of dealings. This new seasoned visitors which have a good Va loan can add worthy of to the transaction or perhaps a challenge. Its as much as the genuine auctions to negotiate a good win-win contract.

cuatro. The fresh new Virtual assistant mortgage can have loose borrowing requirements or otherwise not.

To understand a few of the almost every other gurus you need to understand just what good Virtual assistant Financing was. An excellent Va loan is a mortgage approved by the individual lenders and you will partly backed, otherwise secured, by the Agencies off Experts Facts. It is therefore clear, the brand new Service out-of Experts Items doesn’t create an effective Virtual assistant Loan. The brand new Va Loan was a hope into the lender getting area of your loan worth. That is right. Not the complete mortgage but a share of mortgage worth.

Loan providers tend to nonetheless check your credit scores, income top, and other what to determine recognition, additionally the rate of interest you’ll get therefore, the borrowers satisfy lender standards. On one hand the lending company seems they may be able has looser mortgage conditions since area of the mortgage try protected. But at exactly the same time it is hard and you may costly to foreclose with the a mortgage. The way the lender balance these problems tend to determine the way the 2nd partners masters gamble away. And why it is good to here are some multiple bank to have good Virtual assistant mortgage.

5. Certain Virtual assistant loan lenders can perhaps work with highest DTI rates to build a loan.

Va loan providers fundamentally use the degree of 41 percent of one’s gross month-to-month money to the major costs, for example a home loan fee or figuratively speaking. However some lenders want far more Virtual assistant funds for the books and you may accept a top DTI ratio but still create good Va house mortgage. Specific lenders might go up to 55 per cent or more based in your power to pay-off the mortgage based on earnings or other credit points. This can allow more relaxing for particular customers to increase its household purchasing stamina. The fresh new monthly mortgage repayment are impacted by the interest cost within committed of your loan. Virtual assistant money are recognized for its competitive costs.

6. Specific Va loan lenders could work having foreclosure and you will bankruptcy most useful.

Particular Virtual assistant loan lenders are working into the problem of foreclosure and you may bankruptcy proceeding. Anyone else will not. It is possible to safer good Va home loan merely two decades removed from a foreclosures, brief selling or bankruptcy proceeding. Sometimes, veterans just who file for Chapter 13 personal bankruptcy safety will be eligible simply per year taken out of the latest filing go out. Even when the veteran has actually a foreclosures into an effective Va-backed financial, he may remain qualified to receive an alternate.