The difference Anywhere between FHA, Virtual assistant, and you can USDA Mortgages

FHA versus Virtual assistant compared to USDA Fund

If you’re getting ready to get a house, determining which financial is right for you is essential. However can go to possess a normal financial, possibly one of many authorities-insured applications will ideal suit your condition.

How can you Choose between FHA, Virtual assistant, and you will USDA Money?

These types of government-insured finance commonly fundamentally right for men and women, but you will dsicover this one of those software will be your best option when delivering a home loan.

Just like the federal government is insuring financing generated due to these types of programs, it allows loan providers installment loans Houston Missouri to give currency to help you borrowers it wouldn’t undertake. Consequently you might not you need as good a cards get or background, and you don’t have to conserve as frequently currency getting a good downpayment more often than not.

Understand that down payments differ from earnest money. Earnest money is needed for extremely household purchases that’s held during the escrow until closing.

To choose between this type of financing systems, you should first select those that your qualify for, as it is unlikely might be eligible for all of them.

FHA Fund

When you favor a keen FHA mortgage, the government makes sure the loan. This permits loan providers to provide fund to the people which can maybe not be eligible for conventional mortgage loans, if you are nonetheless offering glamorous terminology.

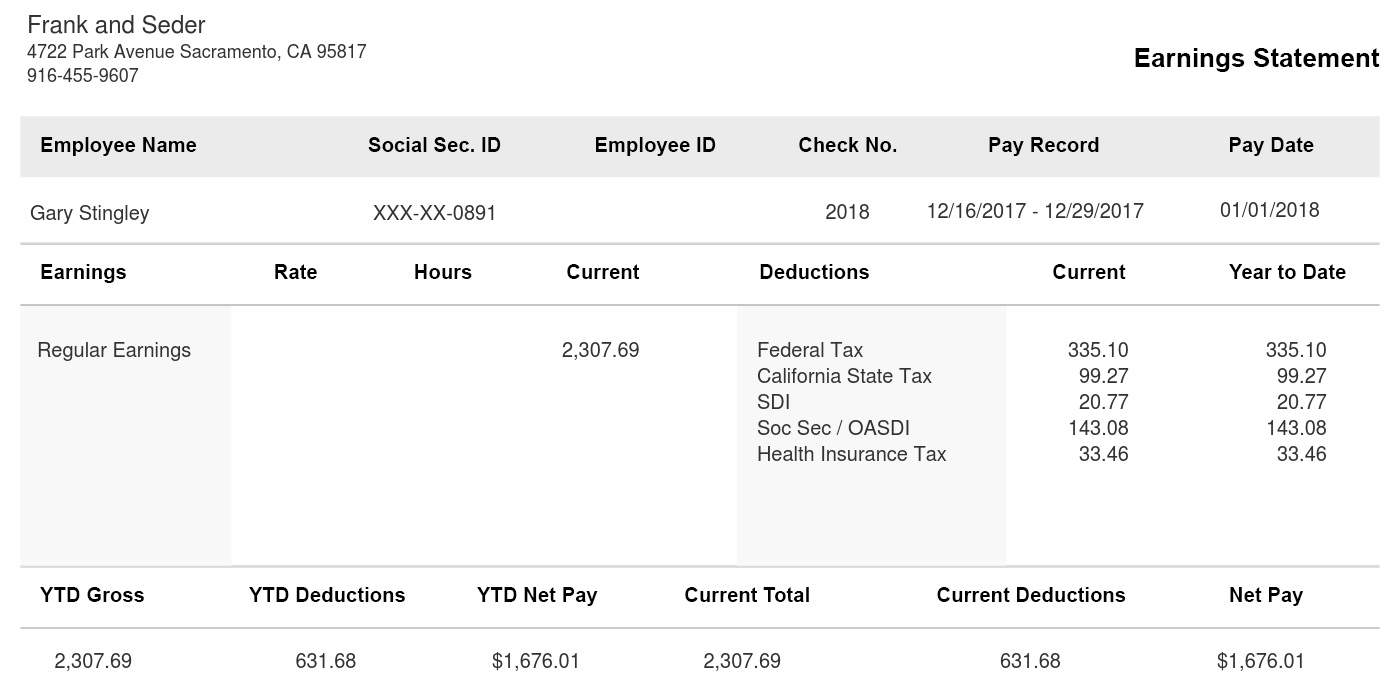

An enthusiastic FHA loan do require a steady income and you can stable payment history over the past 2 yrs. If you fulfill these types of criteria, you could potentially qualify for that loan that would or even never be readily available due to old-fashioned mortgage loans.

Credit rating minimums

If you don’t have the best credit, you’re expected to be eligible for an FHA mortgage more a conventional home loan. If your credit score is just average or not even that a, you can still qualify for an enthusiastic FHA mortgage.

Off costs

While you are an initial-time borrower, extremely common to obtain help from family unit members, together with FHA allows for it. In the event that a family member or even a close friend donates currency to meet up this new down payment needs, a gift letter must be created, and you may bank comments may be needed. The newest debtor should get-off the bucks in their membership after they keeps transferred they, up until closing.

The cash toward downpayment may are from coupons, or taken out of 401Ks and you will IRAs. Regardless of if when you have anyone prepared to provide the money, it makes buying a property convenient since you will not have to spend age preserving to the down payment.

Versatile fund

A keen FHA mortgage could possibly offer your a lot more solutions more than most other mortgage types. You need to use these types of mortgage to buy an excellent duplex your local area surviving in one of many products and you will leasing from the someone else. You can also use this financing buying an apartment, although it has a lot more conditions compared to an individual household members household buy.

You could potentially improve refinance otherwise cash out guarantee through a keen FHA mortgage too. This will enable you to pay off almost every other costs otherwise treat the eye you have to pay to the financing.

Whenever is actually an FHA Financing Perhaps not Appropriate?

Whenever a debtor provides lower than an excellent 20% deposit, private financial insurance policies will need to be paid back monthly. While this is a comparable disease having conventional home loans, new FHA means a supplementary initial premium.

Besides, when you yourself have over 20% equity of your home having a conventional mortgage, PMI will not be billed. However with an FHA loan, it would be always been paid if you don’t refinance.

- 183 Offers