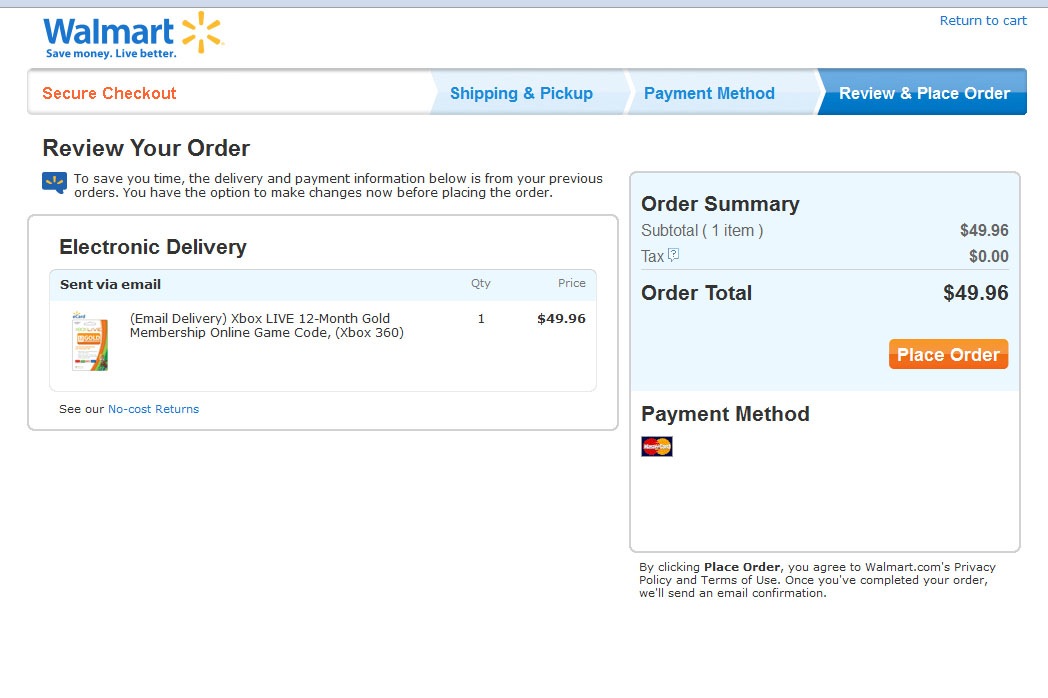

The firms Where Group Usually Score Payday loan

Two times as of several payday loans users focus on Walmart as compared to the next common providers, Kaiser

Cash advance can be used from the individuals who you prefer money timely, whom usually have no alternative way from borrowing currency to pay for an unexpected expenses. The advantage of these kinds of finance is because they allow you to generally meet your own instantaneous financial obligations. The risk, yet not, is that you is actually taking on loans and you will incurring future financial obligation you to need future income to get to know.

In this article, we’re going to become familiar with use status of people who take on payday funds. Manage he has got operate that will enable these to pay back new funds in a timely fashion otherwise are they cornering by themselves with the an amount of financial obligation without having any money so you can actually ever pay-off the new finance?

On LendUp, we provide financing to those to cover unanticipated expenses or when they require the cash punctual. Due to all of our many years of underwriting fund and working with the help of our people, we all know much towards monetary history in our mortgage readers.

In this research, we shall remark the info into work features out-of Us citizens just who turn-to payday loans. Exactly how many individuals who check out payday loan has jobs? Are they functioning full-some time and in which would they work?

We found that brand new challenging most of payday loans recipients (81.2%) has regular operate. After you range from the quantity of users that work part-go out otherwise are usually resigned, one makes up about over ninety% regarding recipients. Most commonly, payday loan users operate in conversion process, office, and you will health care support. The most used employer from LendUp profiles just who find a pay-day mortgage try Walmart, accompanied by Kaiser, Address and you can Domestic Depot.

As part of the application for the loan techniques, we query consumers to say the work updates and you can newest manager. For it data, we assessed funds off 2017 so you’re able to 2020 observe more common a career condition, industries and businesses. The content is actually off claims where LendUp currently works (WI, MO, Colorado, Los angeles, MS, TN, CA) including a lot more claims in which i prior to now produced finance (IL, KS, Los angeles, MN, Ok, Otherwise, WA, WY). When considering widely known companies away from cash advance recipients, these details lay usually mirror the largest businesses within prominent avenues, such California.

81.2% of all the pay day loan users to the LendUp has actually complete-date employment, and thus they want to enjoys money going to pay back their expense. Additionally, some body use payday loans to pay for timing mismatch of having a price coming in before income will come to cover it. For individuals who include those that is area-day working, resigned, otherwise notice-used to individuals with complete-date a career, you be the cause of 96.1% of payday loans recipients. Just step one.2% out of pay day loan users are classified as unemployed.

To start, why don’t we look at the a career standing of individuals who rating pay check finance via LendUp

As an element of all of our app processes, LendUp payday loans recipients report details about its community out-of a position. Next graph stops working mortgage receiver by the business:

The most famous world for in need of an instant payday loan are conversion process related. This could is retail experts otherwise telemarketers taking care of good payment with an erratic spend schedule. The following most commonly known marketplace is people doing work in office and you will management. From note, the 3rd common classification try medical care associated.

Finally, let’s glance at the companies with pay day loan readers. As stated americash loans Winsted previous, keep in mind that these details reflects the utilization foot from inside the areas where LendUp operates which and big businesses will appear more frequently on the below listing:

Walmart, the largest manager in the us, is the count boss out of payday loan receiver due to LendUp. The list are reigned over because of the merchandising businesses, as well as health care, studies, and you can regulators.

Within this investigation, there is shown the most regarding payday loans readers are functioning full time. Even after generating a normal earnings, expenditures come up that people don’t have the checking account stability to pay for. Most of these individuals work in college, hospitals, and areas that have provided important attributes on the pandemic. Anybody get cash advance to fund immediate expenditures, and for of a lot Us citizens, such on the internet loans may be the merely way to obtain financial support available during times of disaster otherwise when economic demands exceed readily available money.