To get a house Once Case of bankruptcy: Is it possible & When?

Table regarding Information

Navigating the industry of a property and you can mortgages once personal bankruptcy could possibly get see disconcerting. Although not, to order a home after bankruptcy is wholly feasible that have mindful believe, reconstructing the bad credit, and you will patience.

Regardless if you are interested in modern apartments within the Miami, otherwise suburban households available in Boston, i receive one discuss the latest comprehensive property posts, where you can find some alternatives which can suit your demands and you will funds.

So, when can you get a property immediately after personal bankruptcy? On this page, we will mention the topic and you may respond to your entire questions.

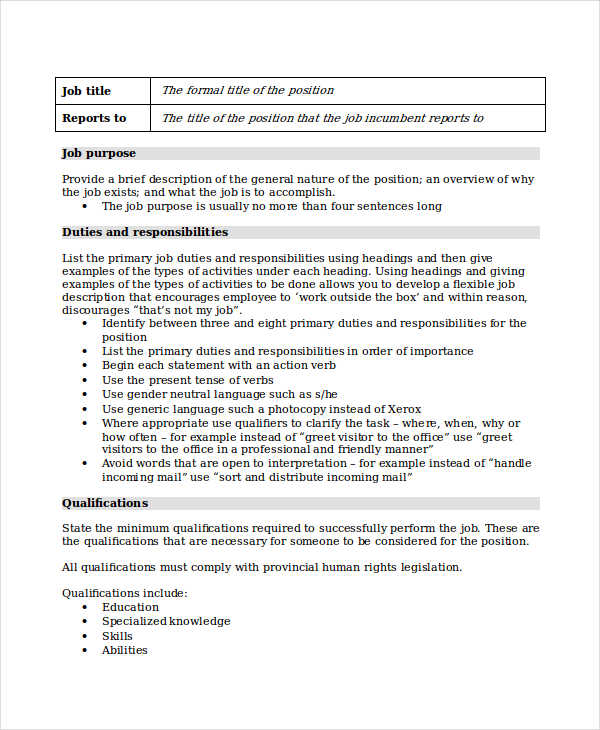

Information Bankruptcy

Bankruptcy proceeding was a legal step pulled from the some one or people unable to satisfy the an excellent costs. It permits towards restructuring otherwise discharging bills, taking a unique begin to men and women overwhelmed by the its bills. Yet not, in addition comes with the express from demands, you to getting the impact on your credit score.

Just like the a possible homebuyer post case of bankruptcy, it’s imperative to comprehend the intricacies from case of bankruptcy and how they can impact your chances of to get a house. Immediately after a bankruptcy filing, your credit history may possibly not be best, but do not allow this dissuade you from exploring the odds of homeownership.

According to the sort of personal bankruptcy submitting-A bankruptcy proceeding (Liquidation Bankruptcy proceeding) or Chapter thirteen (Payment Package Bankruptcy proceeding)-it may remain on your credit report to have 7 so you can 10 age. Nevertheless, it doesn’t mean you really need to waiting which a lot of time to shop for a home.

Since the personal bankruptcy remains a black mark-on your credit history, its perception lessens over time, particularly if you make typical payments and keep your financial health under control.

Understanding the details of homebuying immediately after bankruptcy is vital to browse the method, find the correct version of mortgage, and prevent coming monetary mismanagement. Suitable degree tend to encourage one move past this new bankruptcy proceeding mark and you may action with certainty on homeownership.

We are going to delve into the new timelines connected with how long case of bankruptcy remains on your credit reports, the desired prepared episodes for different loan designs, and ways to rebuild your credit score effectively.

Preparing to pick a home shortly after case of bankruptcy involves trick measures one to usually place you on the road to homeownership. Which planning phase comes to a variety of budgeting, saving, and you will borrowing from the bank-building strategies, and selecting a trusting mortgage lender.

Strengthening their borrowing and you will coupons is the vital thing immediately after submitting bankruptcy. Think of, credit ratings gamble a significant role into the a great lender’s choice in order to approve your financial software.

Credit bureaus track your financial decisions and update your credit report consequently, affecting your credit rating. The key to improving so it score lies in and then make your repayments punctually. This can include your own mastercard payments and all of normal payments, just like your mobile phone payments and other monthly installments.

Ways to Rebuild Borrowing

A protected bank card otherwise a payment loan are an enthusiastic excellent start to building your own borrowing immediately following bankruptcy proceeding. Such personal lines americash loans Springville of credit provide a patio to display what you can do to handle borrowing sensibly. Ensure that you maintain your credit card equilibrium better using your credit limitation to help you impact your credit score positively.

While doing so, starting a strong offers practice is actually incredibly important. They shows your financial balances and you can maturity to handle a home loan. And, the greater number of you save, the greater the newest downpayment you can afford, potentially causing down monthly mortgage payments.

Realistic Budget and a reliable Financial

Interested in a reliable financial is yet another extremely important aspect of the family to shop for process. Some other mortgage brokers may offer different loan items, for each and every with its very own mortgage requirements, interest levels, and you can terms. Thus, browse and you can evaluate the choices, given facts such as the lender’s reputation, customer support, as well as the full loan costs.