Your self-help guide to the first Possessions owner Offer

- Property

- Seemed

While thinking about purchasing your earliest home, you could be eligible for financial assistance playing with government programs one to help basic homebuyers.

Based in which you pick, you’re going to deal with very different standards and discovered very different amounts. Their financial will help you that have researching costs and you will offered features or concessions.

It of good use help guide to the initial house client give might help you probably know how locate one-step nearer to home ownership.

What is the very first homebuyers offer in australia into the 2024?

This grant is available for your requirements whenever you are strengthening or to shop for a new domestic. The new strategy are financed from the for every single condition and you may area authorities, therefore for each city keeps quite different qualification standards.

Having qualified to receive the first resident grant?

All round conditions for eligibility is similar round the all states and you can areas, with exclusions. Some of the common requirements includes another parameters:

- You might be to get or building the first household you to definitely no body has stayed in in advance of, otherwise a house which was dramatically remodeled.

- You’ve never had assets around australia.

- You might be a keen Australian resident otherwise a permanent resident away have a peek at this website from Australian continent.

- You’re no less than 18 years old.

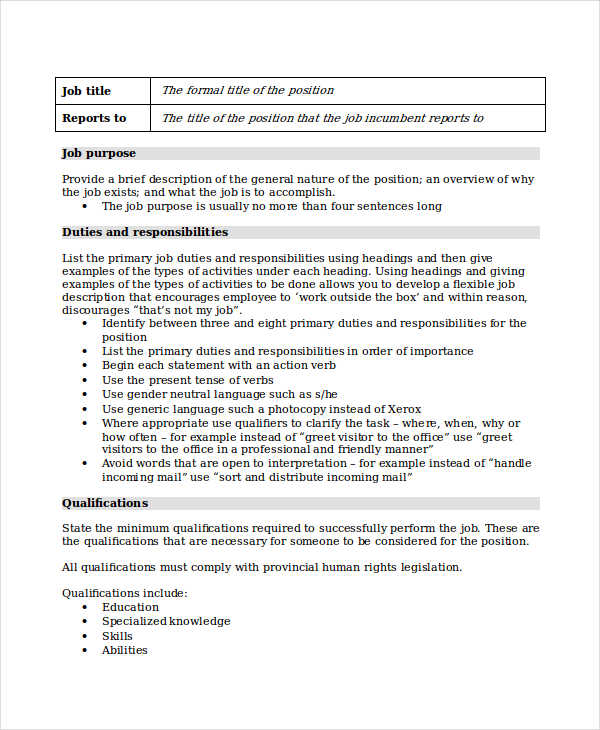

Just how to apply for the first home owner grant

If you want the fresh new grant to help contribute to the purchase rates and you can expenses associated with purchasing your household at payment, you ought to fill in the job together with your financier when they are a prescription broker.

If you’ve ordered your residence, you could potentially hotel a software into funds work environment for the condition thru the particular First home owner grant on the internet portal.

Earliest Property owner Grant Queensland

With the Queensland Earliest Property owner Give, qualified buyers will get a give out of $30,000 to the to acquire otherwise building another home if package are closed between .

To be entitled to brand new offer you should be to find or building another type of home respected less than $750,000. This consists of homes and you can people strengthening deal distinctions. You should transfer to your brand-new home within one 12 months out of settlementif its an existing house or if perhaps strengthening whenever construction is done and you may a last evaluation certification are provided.

You really need to live truth be told there as your prominent host to home to own a continuous six-day several months at least. If you have to get-out during this time period, the government will get request which you pay the new offer.

You aren’t qualified to receive this new QLD basic resident grant if the you, or any client active in the get, have previously possessed assets around australia.

Basic Property owner Give The brand new South Wales

NSW has a few different options for people seeking to get for the property market. There clearly was a great $10,000 NSW very first homeowner give designed for recently depending, from the plan, or significantly renovated land.

To get entitled to the new grant, you must be to get property one no-one enjoys existed when you look at the ahead of otherwise could have been dramatically remodeled by provider and cost have to be not be more than $600,000.

If you are building a home on the empty homes, however, then your mutual costs for a home and residential property bundle having comprehensive strengthening bargain must not be more $750,000 (including the cost of people building differences).

Would earliest homebuyers shell out transfer duty in the NSW?

You can find concessions to the transfer duty having attributes significantly less than $1,000,000, if you find yourself consumers to find house less than $800,000 aren’t expected to pay people import duty whatsoever. With regards to the initial worth of, this can help you save an extra $31,000.