That have an effective TD signed home loan, you really have a couple prepayment choice:

TD also offers multiple mortgage payment frequencies outside of the fundamental month-to-month home loan fee, and also the independence to line-up repayments along with your paydays. With good TD mortgage, you could potentially select from next payment options:

- Monthly

- Semi-month-to-month

- Fast partial-month-to-month

- Bi-each week

- Fast Bi-each week

- Per week

- Rapid-a week

Towards rapid payment options, you get while making even more money on your own financial over the course of a-year to help pay it off reduced, and you can save money on appeal.

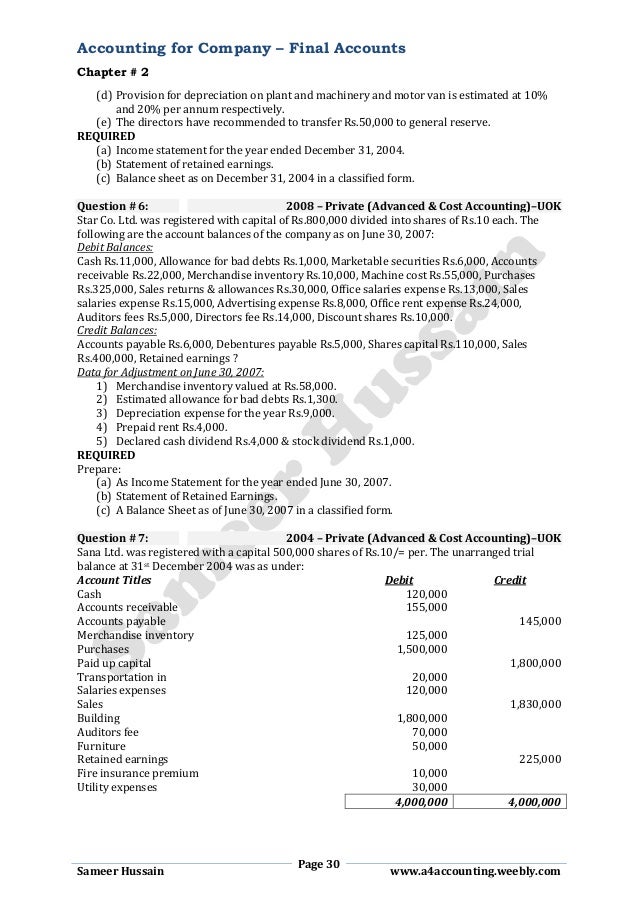

Prepayment privileges

Nearly all mortgage lenders give prepayment possibilities with the closed mortgage loans to help you let pay their mortgage off less without an expensive penalty. Sadly, TD cannot frequently give prepayment privileges that are because generous otherwise versatile as some of the most other Huge 5 Finance companies.

Annual lump sum: one time per year, you could make a lump sum payment count which is no more than 15% of completely new financial balance. Such as for example, if the fresh financial harmony are $350,000, you can fork out so you can a supplementary $52,five-hundred into your own principal on a yearly basis.

Enhance your homeloan payment: one per year, you could potentially increase the amount of their typical mortgage payments because of the around 100% of your brand spanking new percentage matter. Eg, should your typical mortgage repayment is actually $1,500 a month, you might raise your monthly payment matter to $step three,000.

Prepayment charges into a shut financial

- Exceed your own prepayment privilege count

- Pay their mortgage balance or name part until the stop of your identity

- Button lenders and you will pay-off your TD financial or term piece up until the prevent of your own term

If you have a changeable rate TD home loan, your own prepayment penalty is 90 days worth of attract to the the modern equilibrium. For those who have a fixed rates TD financial, their prepayment punishment could be the highest of two various other computations: either ninety days property value attention towards the latest equilibrium, or the Interest Differential (IRD). New IRD are computed in line with the newest home have a glimpse at this link loan equilibrium which have the interest rate you may have, as opposed to exactly what your home loan equilibrium might possibly be on latest published speed and you may with no offers.

Prior to making an additional payment, TD offers an effective prepayment charges calculator to see if you’ll be able to become billed a penalty, assuming very, how much it might be. Open TD mortgages are not susceptible to one prepayment punishment charge.

TD mortgage things instantly

Typically the most popular TD home loan ‘s the important 5-year fixed price closed mortgage, accompanied by the five-season changeable speed finalized home loan. TD changeable mortgage loans promote a fixed payment solution. The level of your own homeloan payment will continue to be a comparable even because the pricing vary. Alternatively, the percentage of the payment that visits dominating and focus will change when your pricing change, your full fee matter won’t.

TD’s released financial costs derive from a 25 12 months amortization; the total longevity of their mortgage loan predicated on your rate and you will payment. You might consult an extended amortization as much as all in all, thirty years, but expect a high rate of interest. During composing, I became not able to get the prices to possess a 30 year home loan, nevertheless the globe standard may be from the 0.10% more than a twenty-five seasons mortgage. Brand new amortization towards the an insured mortgage, eg a top proportion CMHC mortgage, can’t be longer previous twenty five years.

TD closed mortgages appear in title lengths regarding six months to help you 10 years. Unlock mortgage loans should be converted to a sealed home loan any kind of time day. Changeable rate mortgage loans can be changed into a predetermined rate mortgage at any time. Requirements and you will limitations pertain.