Can i put money off with an effective USDA Financing?

The fresh Keystone Financial Program is actually offered to very first-time home buyers, veterans, and you will homebuyers in certain areas for the Pennsylvania. It offers resource to possess traditional mortgage loans, USDA money, Va fund, or FHA fund. However, you really need to be certain that perhaps the financing meets the household income and cost restrictions. PHFA Keystone Advantage Recommendations | 0% Attract Down payment Assistance to have PA First time Home buyers. This new Keystone Virtue Guidance system will bring a great 0% appeal second home loan all the way to cuatro% of your purchase price otherwise $6,000 used on their settlement costs and you can off percentage.

What’s an effective USDA Loan?

A USDA Mortgage is even entitled an outlying Development Mortgage, due to the fact system was created to make teams within just-setup outlying portion by simply making to purchase property inexpensive. Instance a keen FHA Loan, a USDA Loan is actually a federal government insured home mortgage, therefore will bring 100% financial support to low-money buyers. This choice was created to help low so you’re able to reasonable money parents go home ownership inside the rural organizations. There’s a lot of information going swimming on the internet from the USDA Money. You may have viewed advertising that claim you can purchase an effective home with no cash off along with no closing costs. During the par value, that’s right. USDA Funds enables accredited consumers to acquire a good home with no money of one’s own. But not, a buyer need to see multiple financial requirements along with location standards getting entitled to that it loan program.

No. In reality, the house buyer is required to acquire 100% of your own cost, which will be funded along the financing identity that is essentially thirty years. And you will in the place of a number of other fund, an excellent USDA Mortgage allows particular can cost you becoming financed for the the loan, and you can makes it possible for the buyer locate a vendor borrowing from the bank in order to contribute to your settlement costs. Without currency needed during the closure and you can a minimal price regarding PMI (home loan insurance rates), the new USDA financing system is really appealing to first-time home people, yet not limited to earliest limited by first-time homebuyers.

Exactly what are USDA Mortgage Conditions to own Pennsylvania?

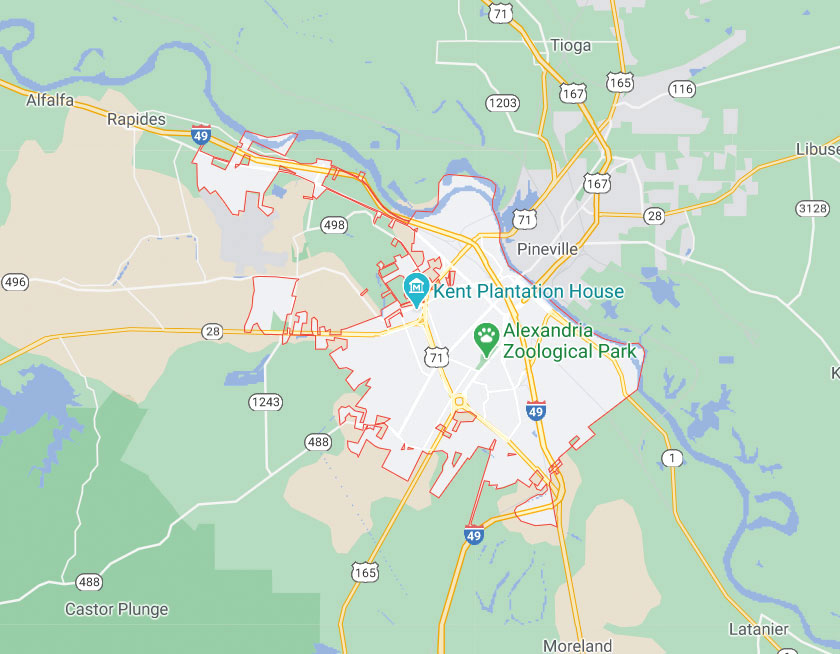

To begin with, individuals must buy a home in the qualified rural parts, that will will vary by the condition. However, even with a familiar myth, an excellent USDA mortgage cannot reduce customer to buying merely farmland. Their financial elite group will upwards a specific possessions otherwise people and you can tell you when it qualifies for this system.

A unique misconception is that the USDA Loan Program is for very first time home buyers. Though it provides good selection for a qualified buyer who is now leasing a flat or sharing living space with an alternate family unit members, the borrowed funds isnt limited by first-time people.

The newest USDA mortgage possess a set of money standards, additionally the applicant’s home income try not to exceed the fresh new depending restrictions, that will differ by the condition. not, there are a few deductible adjustments into total money, and this capture expenditures instance child care into account. Home financing top-notch can help figure out which earnings should be omitted from the calculation.

There are even particular credit rating conditions, which could never be as rigid since you envision. When evaluating payday loans in Crystal Lake programs, higher benefits is put into borrower’s credit rating rather than credit rating. Financing processor could well be wanting a reputation desire and power to pay loans: a noted regular income and texture regarding paying off credit cards or other bills regularly. Credit score is also a factor in the application procedure, but a bad credit rating does not fundamentally disqualify you.