USDA Financing All you need to Know

Everything you need to Find out about USDA Money

There are many paths so you’re able to homeownership in the us. One is the fresh Point 502 Protected Mortgage System, also referred to as a great USDA mortgage. Simply speaking, it will help approved loan providers to add reasonable- and moderate-earnings anybody an opportunity to own a primary quarters within the qualified rural components. Specific candidates can be elect to build, get otherwise treatment a preexisting home otherwise move around in a medication dwelling in the qualified outlying area, most of the with 100% financial support. There is lots way more to a good USDA mortgage than the fresh new first meaning. This is what you must know from the USDA loans from inside the Western Vermont.

Who can Implement

- Being a beneficial United states citizen or courtroom permanent citizen

- A credit history with a minimum of 640

- A stable and you will dependable income

- Desire to settle the loan with 1 year off no later money otherwise selections

- Modified domestic earnings comparable to otherwise lower than 115% of your own urban area average money

- The house or property try an initial home when you look at the a professional outlying urban area

What makes a place Eligible

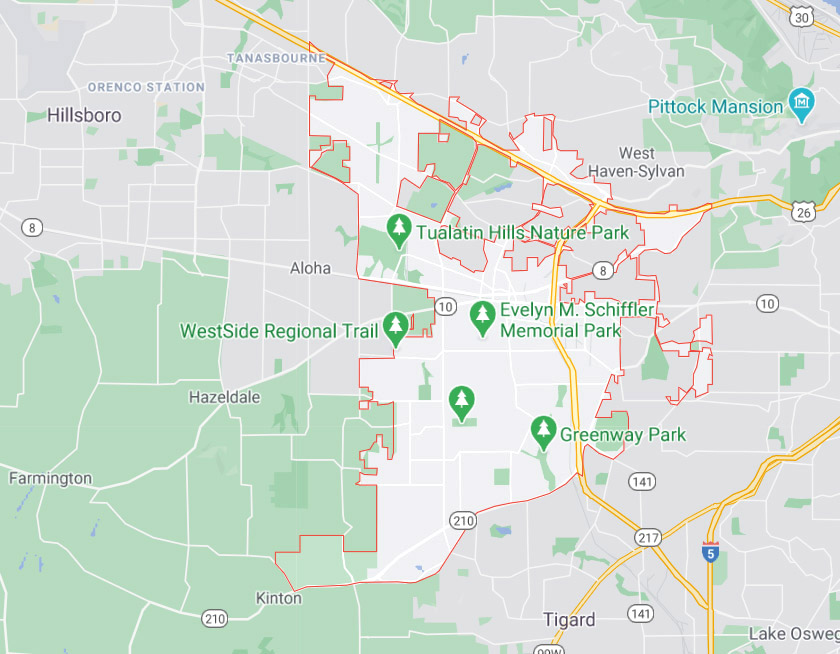

USDA finance safeguards outlying portion. In West New york, that can imply many things, in addition to in towns and cities really close to the urban area. Many people believe that rural form farmland, although that is not totally genuine. If you are large urban centers and you will suburbs do not meet the requirements, the new USDA considers certain portion having a people regarding less than thirty-five,000 to get rural. New USDA features around three number 1 kinds to own possessions qualification.

- Just about ten,000 owners

- Populations out of 10,001 and you will 20,000 that are not within the a primary metropolitan analytical town

- Parts anywhere between 20,001 and you can thirty-five,000 missing outlying standing inside the 1990, 2000, or 2010 census with a lack of mortgage credit.

Exactly why are they Not the same as an effective Virtual assistant or FHA Loan?

You can find bodies fund, so what helps make the USDA loan different from Va otherwise FHA finance? For more information, we advice your keep in touch with the group at GoPrime Home loan during the Western Asheville, however, here is a quick evaluation.

Which are the Earnings Requirements

Discover five money computations the fresh USDA make into the financing way to determine the income edibility of debtor.

Minimal USDA demands is actually for applicants to have a reliable and you may verifiable money anticipated to keep. To decide uniform a career, lenders tend to typically make certain money by considering 2 yrs off tax statements and you may latest spend stubs.

Home income relies on the brand new estimated earnings of every adult affiliate. All of the adult occupant’s income will amount to the the family restriction, in the event they aren’t towards the loan.

New modified yearly income depends on deducting this new acceptable write-offs from your yearly earnings. Their bank will allow you to by this strategy to be sure everything you try consistent and you will best.

The fresh new USDA establishes constraints concerning your limit amount of modified annual earnings on home. They wish to make sure the suggested users meet with the program’s assistance to have lower and moderate-income teams. The average limits was $91,900 getting domiciles of 1 to help you five and you will $121,300 for five to 8.

New USDA really does to change having regional distinctions, that is why dealing with a city separate lending company was extremely important. They have place the base earnings top during the 115% of your own area’s median house money.

You’ll want to know the difference in the new USDA’s being qualified income and you will payment earnings. Qualifying income is utilized to ensure consumers meet the income conditions, but cost money concerns the ability to pay off the borrowed funds.

Your financial usually determine the job of the figuring the debt-to-money proportion or DTI. The latest USDA sets the high quality DTI during the 41% due to their financing. Which means individuals is always to spend more than simply 41% of its month-to-month income towards debts. You’ll get a beneficial USDA loan when your DTI is large, it may include alot more stringent financing requirements.

What are the Borrowing from the bank Requirements

Potential real estate buyers trying to get a beneficial USDA financing need certainly to demonstrate secure and you will reliable money and you may credit history that shows he could be ready and you may willing to pay off the borrowed funds. There is absolutely no minimum credit importance of USDA financing, however, applicants with a credit score out of 640 or higher can also be qualify for this new automatic Underwriting

When the a candidate features a credit rating out-of lower than 640, they might be eligible but would need to undergo a manual underwriting process with more rigid direction.

You should observe that applicants instead of dependent credit may also meet the requirements, although processes will need credit verification from other provide like since book, power, and you will insurance policies payments. These principles may differ because of the financial.

How to start off

As with any property experience, we always strongly recommend potential individuals affect a neighborhood independent financial financial. They can walk you through the procedure, determine if your income and credit meet the requirements, and you can express information having agents who’ll help you find property from inside the qualifying outlying elements.

You may look at the USDA website to done their eligibility character http://www.elitecashadvance.com/installment-loans-mo/richmond to decide whether it would be an excellent road to homeownership to you personally.

Get in touch with GoPrime Home loan in the Western Asheville for more information. Do you wish to see the home loan procedure top and have preapproved for your next household pick? Phone call the team within GoPrime Home loan today. GoPrime Home loan in the West Asheville is here now to help. Contact us today on 828-348-1907 GoPrime Home loan inside the West Asheville.