What is the difference in mortgage safety insurance coverage and you may lender’s financial insurance policies?

Your property financing tend to usually be your largest personal debt, when you are your home is the premier advantage. One way to always are able to keep purchasing your loan away from and retain possession in your home has been Home loan Safety Insurance coverage (MPI).

But is home loan security insurance coverage worth it, or perhaps is it an irrelevant insurance policies create-into the? Learn here, and exactly how much it will set you back and you can what it talks about.

What is home loan shelter insurance coverage?

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/AHKY5NMYENESGFFDCZDPZXHR2M.jpg)

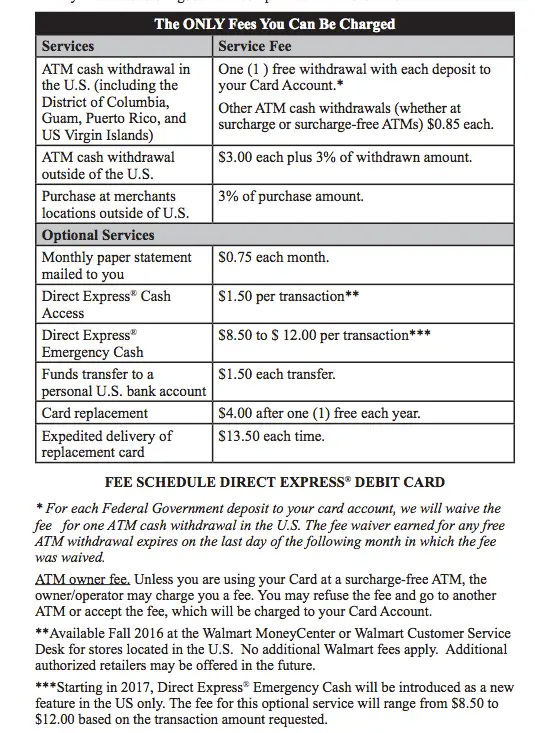

Mortgage safeguards insurance policy is a type of coverage where borrower are safe in case they may be able no further pay the home financing due to certain events eg:

- Jobless

- Important illness

- Burns off causing you to incapable of work

- Demise

Home loan shelter insurance will help you cover your residence loan costs in the event the such unplanned items arise. By since the mortgage for individuals who perish, they guarantees your own beneficiaries will be able to take care of the home.

Part-go out otherwise informal teams in addition to mind-operating, all working less than 20 era each week, usually generally speaking not be able to get cover.

Some people could possibly get confuse home loan safeguards insurance policies and you may Lender’s Financial Insurance (LMI). The difference between the two is that mortgage protection insurance handles your in the event you default into the loan.

While doing so, your bank try covered by lender’s financial insurance policies in case you default to your loan. As opposed to insurance rates being constantly recommended, LMI might be necessary and can be applied whenever a debtor are unable to shell out a deposit of payday loans Westcreek at least 20% of the property’s price.

How much does home loan security insurance policy?

- A single-off swelling-sum commission towards the a good balance of the home loan. People kept finance may be used by your family members to have whatever purpose.

- A payment per month to cover your repayments due to your suffering serious disease otherwise burns off. These costs ranges from 30 days to three decades.

- A monthly payment to pay for your instalments due to shedding employment – will not any longer than simply 3 months. Financial safety insurance policies only discusses unemployment if you’ve been discharged or produced redundant – maybe not if you have stop your task.

One to extremely important point out mention is actually extremely regulations exclude people pre-established medical conditions. Eg, when the a medical professional keeps cited your because the that have an illness otherwise burns throughout the 1 year prior to buying the insurance coverage, it’s unlikely you will be covered.

- How big is your loan

- The brand new fees count

You could potentially buy mortgage shelter insurance rates possibly just like the a swelling share percentage or if you could probably create your commission month-to-month, based the insurance company.

In most cases from flash, financial safety insurance rates rates up to 0.5% to a single% of your amount borrowed to the an annual base. When you shop around for a keen insurer, make sure to get a range of prices to be certain you are acquiring the cheapest price.

Do you want financial security insurance policies?

Financial cover insurance just discusses you for the home loan repayments is to you sustain a conference one to has an effect on your income. It indicates, you will still possess almost every other costs to expend such as for example: bills (times expense, mobile expenses), vehicle registration, college tuition charge, and dining expenditures.

Are there selection so you can home loan safety insurance policies?

If you feel financial protection insurance coverage might not be right for you, here are some other options to take on, all of these can deal with home loan repayments.

Life insurance policies

Also referred to as dying shelter, life insurance coverage pays away a lump sum so you can anyone who was selected on the plan when you die. Just like the people can use the money having whatever they would you like to, it could go into the mortgage repayments and any other expenses.

Earnings shelter

Money security talks about you in the event you cure your earnings in order to problems or injury. Its built to protection your revenue from the doing 85%, used as you want (for all the expenditures, not merely the borrowed funds). To track down shielded, you must shell out a fee every month.

Complete and you can long lasting handicap (TPD) safety

TPD offers a lump sum to possess long lasting death of works due to serious illness otherwise injury. Will added to life insurance policies, you can use the fresh new commission to fund your own mortgage repayments and you can other needed expenses.

Get in touch with one of our friendly financing pros to discover the tactics on fantasy house for less or save your self thousands on your own current financing.